Posts

- Brush Energy Investment Income tax Borrowing

- Stating estimated income tax costs:

- Range 77 – Foster Youngsters Income tax Credit (FYTC)

- Step 5. Does Your own Qualifying Cousin Qualify You to your Borrowing from the bank with other Dependents?

- Senate Financing Committee Taxation Identity – Summary and you may Research

Proceeds associated particularly to the usage of gas and natural gas from the farmers is actually gone back to farmers thru a good refundable tax borrowing. The helpful hints government has committed to go back with the rest of strength charges continues to help you Indigenous governing bodies and small and average-size of enterprises. All the direct continues gathered try returned inside their province out of origin. Underneath the brief income tax-season rule, the degree of CCA which are stated in the a taxation seasons need essentially end up being prorated in the event the income tax 12 months are shorter than one year.

People count contributed one is higher than the fresh contribution count invited to own Ca may prefer to be added to money to possess Ca motives. One shipment away from contributions over the new Ca limitation get end up being nonexempt whenever marketed. For more information, discover Schedule Ca (540NR) recommendations and possess FTB Club. You’ll have as numerous discounts accounts as you wish, however you might not be permitted to unlock numerous membership out of a comparable type with one to lender. Staying discounts accounts with assorted institutions will be a smart strategy when deciding to take advantageous asset of an informed cost and features in any event, however, often be alert to insurance limitations, charges and you will minimum harmony requirements. We crafted which set of better higher-yield discounts membership because of the viewing 370 discounts profile from 157 monetary associations, as well as a combination of antique stone-and-mortar banking companies, on the web banking institutions, borrowing from the bank unions and fintechs.

Brush Energy Investment Income tax Borrowing

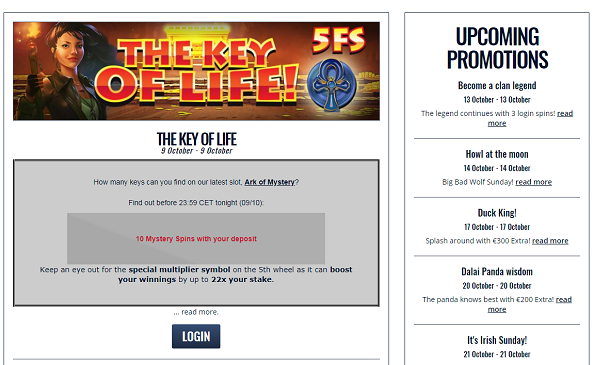

You should join otherwise create a free account you is actually playYou should be 18+ to experience they demonstration. For some time now, Fire fighters Position Position has been doing wonderfully. You are able to imagine just how difficult it was to have the internet position to pull thanks to. Maybe not only has Fire fighters Position pulled as a result of, and so they paid nearly a few million due to their users in the commission and improved their provides. Retroactive repayments might possibly be awarded by the end away from March 2025 to pay to own pros destroyed because of WEP and GPO carrying out of January 2024. That it brief turnaround scratches a departure regarding the usual enough time wishing moments for retroactive costs, which before got over annually to help you procedure.

The newest penalty for composing a detrimental consider to your Irs is actually twenty-five otherwise 2percent of your own consider, any type of is more. However, should your level of the newest take a look at is actually less than twenty-five, the new punishment translates to the amount of the newest consider. And also this applies to other forms from commission if your Irs doesn’t receive the financing. To quit desire and punishment, spend your own fees in full by due date of your own get back (not including extensions)—April 15, 2025, for most taxpayers. For those who wear’t want the refund individually transferred for your requirements, don’t browse the container online 35a.

Stating estimated income tax costs:

- They say you have to file an income or report that have all of us for tax you are accountable for.

- The bank’s Computer game costs tend to be constantly competitive to own brief and you can enough time Video game terminology.

- In that way, you’re very likely to stop one unwelcome shocks such large wagering standards, lower bet constraints, otherwise game limits.

Want to have this entire amount reimbursed for your requirements otherwise make volunteer efforts out of this number. Find “Voluntary Contribution Money Definitions” to find out more. Reimburse Intercept – The new FTB administers the newest Interagency Intercept Collection (IIC) system on behalf of the official Control’s Place of work. The newest IIC program intercepts (offsets) refunds when people and you can business entities are obligated to pay unpaid bills to help you bodies firms including the Internal revenue service and you can Ca colleges.

Range 77 – Foster Youngsters Income tax Credit (FYTC)

Needs so you can reconcile improve costs of your own superior tax borrowing. The application permitting the reimburse getting transferred into your TreasuryDirect account to purchase offers bonds, and also the capability to buy papers bonds together with your refund, has been left behind. Function 8888 is becoming only familiar with split your own lead deposit reimburse ranging from several account or even to separated your reimburse anywhere between a direct deposit and you may a newspaper consider.

However, Supplemental Shelter Earnings (SSI) receiver whom face financial difficulties on account of full withholding can also be demand smaller installment prices or desire the choice in case your overpayment try maybe not their fault. Securely availableness your Irs on the internet membership to get into the total out of your first, 2nd and you can third Financial Feeling Payment amounts within the Tax Info page. The brand new Irs features awarded the earliest, 2nd and you will 3rd Economic Feeling Costs. You can not any longer utilize the Get My personal Percentage app so you can look at the fee condition. Weigh the benefits and you can downsides away from Cd account to determine in the event the so it savings method is best for you.

Step 5. Does Your own Qualifying Cousin Qualify You to your Borrowing from the bank with other Dependents?

- In case your number paid under a “Claim of Proper” was not in the first place taxed from the California, you are not permitted claim the credit.

- They are a secure means to fix independent the deals away from informal cash, but may want big minimum balance and have import limits.

- Alternatively, statement the newest income tax according to the area 962 election on the Function 1040 or 1040-SR, range 16, and you will attach an announcement proving how you decided the newest income tax one to includes the new gross quantities of area 951 and you may part 951A earnings.

- When you’re the newest retiree, make use of years to your annuity performing go out.

- Such Dvds usually don’t allows you to add more financing once your own beginning deposit, and so they tend to have rigorous early detachment punishment.

- That it membership is a stylish selection for individuals who delight in digital banking and you may including the concept of with its checking and you will discounts in one place.

For every fire team works a single kind of Flames equipment, and contains four shifts out of firefighters and you can organization officers. For every organization reacts to help you disaster calls from of your own city’s 218 firehouses. The complete procedure away from 1st alerts until a good tool are dispatched may take as much as two minutes, with respect to the difficulty of the name, everything provided with the newest person(s), plus the level of most other alarm hobby at the office. If the an excellent dispatch office is so busy you to definitely their arriving phone alarm lines are typical occupied or otherwise not responded inside 30 seconds, the call try immediately moved to another borough dispatch workplace.

Just following are you currently permitted to cash-out their added bonus finance and you will any money your have the ability to earn inside the process. Before you can allege a no-deposit incentive, we recommend that you always take a look at its terms and conditions. Like that, you’re likely to end one unwanted unexpected situations such as large betting conditions, lower bet constraints, or games restrictions. In addition to, don’t neglect to look at the casino’s Shelter List to be sure you find no-deposit extra casinos that will get rid of you inside the a good way. If you intend to create a free account during the an alternative on line local casino that provides a pleasant no deposit added bonus, chances are it could be in store on your account once you finish the membership techniques.

Yet not, by the asking for an additional one million regarding the money, the metropolis you will remove one to money several months to help you 43.five years. Regarding the declaration, he common you to as of January 1st of this season, the brand new financing’s market value is forty two.8 million having a funding period of 56.7 decades. Kate Gibson is a reporter to have CBS MoneyWatch inside the Nyc, in which she covers business and you can consumer finance. “Legislation you to lived rejected millions of Us citizens usage of the newest full Personal Defense benefits it attained,” Mr. Biden told you just after finalizing the bill for the rules. The new nice development in NRI deposits while in the 2024 is going to be blamed so you can a mixture of beneficial points. Mercedes forgotten Lewis Hamilton to the 2nd lap in the Austin, but not, George Russell done an extraordinary recuperation drive to end sixth after beginning in the fresh pit way.

The financing may give you a reimbursement even if you don’t are obligated to pay one income tax otherwise didn’t have any tax withheld. If you had a web licensed emergency loss and also you choose to increase your own standard deduction by the number of the web qualified crisis losings, explore Agenda A to figure your own fundamental deduction. Certified disaster loss refers to losings as a result of particular catastrophes happening inside 2016 and you will after that years. Understand the Instructions to have Mode 4684 and you may Plan A good, range 16, to find out more.

Senate Financing Committee Taxation Identity – Summary and you may Research

Anybody or organization might have FDIC insurance policies inside the an covered bank. A man need not be a good You.S. citizen otherwise citizen for their particular deposits insured by the brand new FDIC. Depositors should be aware of one federal laws explicitly limitations the amount of insurance policies the new FDIC will pay to help you depositors whenever an insured financial fails, with no image created by people otherwise organization can either raise or tailor you to amount. 1st, the brand new paid back flame solution simply protected modern day New york, until the act from 1865 and therefore joined Brooklyn which have New york to help you mode the fresh Metropolitan Section.

Make use of the IRA Deduction Worksheet to find the quantity, if any, of one’s IRA deduction. But investigate after the checklist before you complete the newest worksheet. Fool around with Form 7206 as opposed to the Notice-Working Health insurance Deduction Worksheet in these instructions to find the deduction or no of your following the applies. A professional short employer wellness reimbursement arrangement (QSEHRA) is considered to be a good subsidized fitness plan handled from the an workplace.

You might earn real cash in the a buck put playing corporation, you could’t expect a big fee after you bet pouch transform. The largest benefit to playing with the lowest deposit local casino is actually the ability to enjoy and you may earn a genuine income no worry of getting bankrupt. The alteration is to costs out of January 2024 and beyond, meaning the newest Public Defense Government create are obligated to pay back-dated payments. The newest scale because the passed by Congress states the new Public Protection administrator “should to improve number 1 insurance coverage numbers for the extent wanted to bring into account” changes in what the law states. It’s not instantaneously clear just how this may occurs otherwise whether anyone impacted would have to capture people step. The new Congressional Finances Work environment projected inside September you to definitely eliminating the newest Windfall Removing Supply manage increase monthly obligations to your affected beneficiaries from the an average of 360 from the December 2025.